Maximizing Business Funding Opportunities to Accelerate Your Consultancy

Optimizing Your Consultancys Potential: The Value of Protecting Company Financing

Protecting organization funding is a pivotal element for consultancies aiming to maximize their capacity. It helps with needed financial investments in solution, skill, and innovation development. Without sufficient funding, consultancies might battle to accomplish or satisfy operational expenses growth purposes. This restriction can prevent their capacity to adapt to market modifications and bring in customers. Comprehending the ins and outs of funding can significantly influence a working as a consultant's trajectory and success. What methods can be utilized to guarantee ideal financing possibilities?

Comprehending the Role of Business Financing in Consultancy Development

Although lots of consultancy companies start with limited sources, comprehending the role of organization funding is important for their development and sustainability. Access to appropriate funding permits these firms to spend in crucial locations such as talent advertising, procurement, and technology. This investment is crucial in establishing a strong market existence and expanding customer bases.

In addition, effective funding approaches enable consultancy firms to browse unanticipated obstacles and financial fluctuations. By securing monetary backing, they can improve or carry out cutting-edge tasks solution offerings without endangering functional security.

Additionally, well-structured funding can foster partnerships and partnerships, boosting the working as a consultant's capabilities and get to. Inevitably, identifying the relevance of organization financing equips consultancy firms to not just endure but thrive in an affordable landscape, positioning them for long-term success and influence within their industries. Understanding and protecting suitable financing sources is a fundamental action in taking full advantage of a consultancy's possibility.

Identifying Your Consultancy's Funding Demands

As working as a consultant firms look for to adapt and grow in a vibrant market, determining their specific financing needs ends up being necessary for calculated preparation. Firms have to assess their present functional costs, including innovation, staffing, and advertising and marketing costs. Comprehending these prices allows consultancies to evaluate just how much financing is essential to maintain and boost their solutions.

Next, working as a consultants ought to assess their development purposes, such as increasing service offerings or going into new markets. This evaluation supplies insight right into extra funding needed for investments in study, training, or framework.

Additionally, companies need to consider their cash flow patterns, establishing if they need short-term funding for instant expenditures or lasting financial investment capital for sustained growth. By clearly determining these financing needs, working as a consultant firms can create educated approaches, guaranteeing they are fully equipped to secure the necessary funds to accomplish their objectives and maximize their potential in an affordable atmosphere.

Checking Out Various Sorts Of Funding Options

What financing alternatives are readily available to consultancy firms looking to increase their procedures? Numerous avenues exist, each with distinctive advantages and factors to consider. Typical bank finances offer set rate of interest and organized repayment plans, making them a reputable choice for well established firms. Additionally, financial backing supplies substantial financing from investors seeking equity risks, perfect for working as a consultants with innovative ideas yet doing not have sufficient collateral. Crowdfunding platforms present another alternative, permitting companies to elevate percentages from many backers, frequently in exchange for benefits or very early accessibility to solutions. In addition, federal government gives and subsidies may be available, particularly for consultancies focused on innovation or social effect. Lastly, angel capitalists can give not just resources yet additionally beneficial mentorship. By comprehending these diverse funding options, working as a consultant companies can purposefully choose the very best suitable for their growth ambitions.

Crafting a Compelling Business Prepare For Investors

A well-structured organization strategy acts as the foundation for consultancy companies looking for investment. It describes the firm's vision, mission, and distinct worth recommendation, clearly communicating to possible financiers how the working as a consultant separates itself in an open market. Business plan must include detailed market evaluation, demonstrating an understanding of sector patterns and target demographics. An extensive financial estimate is necessary, as it illustrates the possibility for growth and productivity, showcasing exactly how the company's funding needs line up with awaited returns.

The plan must identify essential group members and their certifications, instilling self-confidence in investors relating to the working as a consultant's capability to perform its approach. Risk analysis and reduction methods need to likewise be presented, showing a proactive technique to obstacles. By synthesizing these elements into a natural story, working as a consultant companies can create a compelling company plan that catches you can try these out the passion and financial investment of potential backers.

Structure Relationships With Potential Financiers

Developing strong connections with possible investors is vital for consultancy firms intending to secure funding. Business Funding. Building depend on and relationship can significantly improve a working as a consultant's credibility and beauty to financiers. Participating in open communication is important; sharing insights regarding service objectives, market fads, and economic projections cultivates openness

Additionally, growing relationships through routine updates and progression records maintains capitalists informed and involved, reinforcing their rate of interest.

Listening to capitalist responses and readjusting propositions as necessary can also strengthen these bonds. By prioritizing relationship-building, consultancy firms can create a supportive network of investors who are not only more likely to provide funding yet additionally offer valuable guidance and mentorship. This joint strategy inevitably adds to long-lasting success.

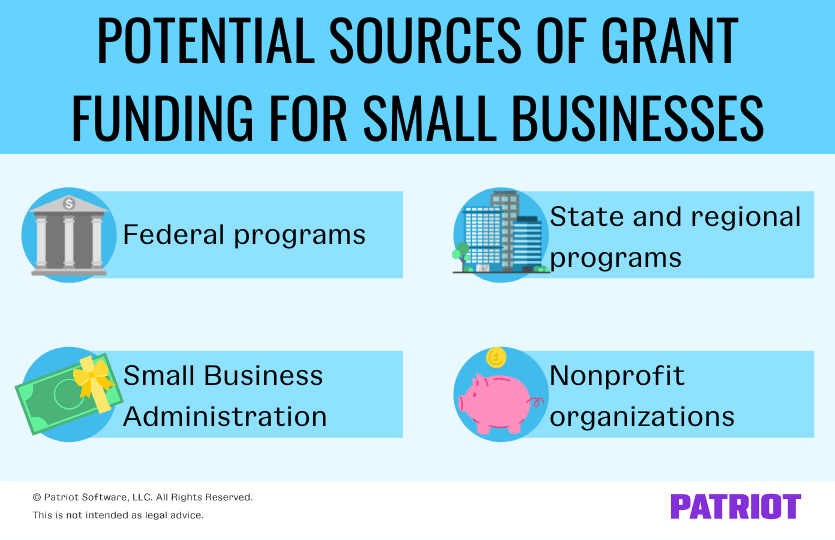

Leveraging Grants and Government Programs

Securing funding from capitalists is just one method for working as a consultant firms; leveraging gives and government programs uses extra sources for development. Numerous consultancy companies ignore these chances, which can offer considerable financial backing without the need for equity dilution. Federal government gives are commonly created to promote development, study, and development, making them ideal for working as a consultants specializing in modern technology, health, or sustainability.

Professionals can access various programs focused on small companies, consisting of mentorship and training resources. These efforts not only supply economic assistance yet also improve integrity, as being connected with government-backed programs can attract extra clients.

To effectively utilize these sources, consultancies should remain educated about offered grants and preserve conformity with application procedures. Structure relationships with city government companies can likewise promote accessibility to moneying possibilities. In doing so, consultancy firms can considerably boost their development possibility and market visibility.

Gauging the Influence of Financing on Your Working as a consultant's Success

Understanding the impact of funding on a consultancy's success requires a careful evaluation of development metrics and financial investment returns. By evaluating how funds add to total efficiency, experts can determine efficient techniques for maximizing their potential. This analysis have a peek at this website not just highlights areas of stamina but additionally reveals possibilities for enhancement.

Funding and Development Metrics

While financing is usually considered as a simple monetary necessity, it plays a pivotal duty fit the growth trajectory of a working as a consultant. By examining growth metrics, firms can determine exactly how efficiently their financing equates into substantial results. Key efficiency indicators such as earnings development, customer purchase rates, and task completion times give useful insights right into the impact of economic resources. In addition, tracking worker performance and contentment can expose the results of investment in training and development. When funding is allocated tactically, consultancies can anticipate enhanced service offerings, boosted operational effectiveness, and stronger market positioning. Assessing development metrics comes to be essential for recognizing the true worth of financing and making certain that economic investments are lined up with long-lasting organization purposes.

Financial Investment Return Evaluation

A comprehensive financial investment return evaluation is crucial for consultancies intending to analyze the effectiveness of their funding techniques. This analysis enables firms to examine the monetary influence of their financial investments by contrasting the gains versus the expenses incurred. Secret metrics such as roi (ROI), web existing value (NPV), and interior rate of return (IRR) offer understandings into exactly how successfully funding is used to drive growth. By systematically evaluating these metrics, consultancies can identify effective campaigns and locations needing improvement. Additionally, a detailed financial investment return evaluation assists in making notified decisions concerning future funding searches and source allowance, eventually enhancing the working as a consultant's general efficiency and sustainability in an affordable market.

Frequently Asked Questions

Just How Can I Enhance My Working as a consultant's Financial Proficiency?

To enhance economic literacy, one should engage in relevant training, look for mentorship from skilled specialists, use online sources, and consistently examine financial declarations. Consistent technique and open discussions about financial resources can even more boost understanding.

What Typical Blunders Do Consultancies Make When Looking For Funding?

Consultancies often undervalue funding demands, fail to present an engaging company instance, neglect to research study financing sources completely, forget capital projections, and lack quality in their financial plans, bring about missed chances and poor support. (Business Funding)

The length of time Does It Generally Take to Secure Financing?

Commonly, securing funding can take anywhere from a couple of weeks to numerous months. The timeline depends on aspects such as the financing resource, the complexity of the proposal, and the responsiveness of both celebrations entailed.

What Are the Tax Obligation Effects of Various Funding Options?

Different financing choices can have differing tax obligation effects; for circumstances, car loans might not be taxed, while equity financial investments can weaken possession and might cause resources gains tax obligations upon sale. Recognizing these subtleties is crucial for economic preparation.

Can I Fund My Consultancy Without Handling Financial debt?

Yes, funding a consultancy without incurring debt is possible through techniques such as individual financial savings, crowdfunding, gives, or angel investments. Each option brings distinctive advantages and considerations, requiring cautious analysis to guarantee positioning with organization objectives.

Numerous consultancy firms begin with restricted sources, recognizing the duty of business funding is important for their growth and sustainability - Business Funding. Eventually, acknowledging the value of organization financing encourages working as a consultant firms to not only prosper however make it through in a competitive landscape, placing them for lasting success and influence within their industries. Developing solid connections with prospective investors is important for consultancy firms intending to protect funding. By prioritizing relationship-building, working as a consultant companies can produce an encouraging network of capitalists that are not only more most likely to supply funding but likewise provide valuable advice and mentorship. Protecting visit this site funding from investors is just one opportunity for consultancy companies; leveraging grants and government programs supplies extra resources for growth